How Disruptions are Born—the Innovation Cycle & the Research Discipline

By Greg Heist, Chief Innovation Officer & Susan Scarlet, Senior Director, Strategic Branding, Gongos, Inc.

It’s easy for us to look at the world from consumers’ eyes, since, at our core, we are all consumers. Think about the first time you held an iPad, watched a favorite episode on Netflix, or talked to your friend using Skype. I’ll bet you swiftly moved from “do I really need this?” to “I can’t imagine life without it.” That reaction was appropriate, since it is the typical response to initial encounters with disruptive innovations.

It’s easy for us to look at the world from consumers’ eyes, since, at our core, we are all consumers. Think about the first time you held an iPad, watched a favorite episode on Netflix, or talked to your friend using Skype. I’ll bet you swiftly moved from “do I really need this?” to “I can’t imagine life without it.” That reaction was appropriate, since it is the typical response to initial encounters with disruptive innovations.

In our industry, we use the term “disruptive innovation” a lot. But, what does this term really mean? In his seminal work “The Innovator’s Dilemma, Clayton Christensen states that a disruptive innovation is a product or service designed for an entirely new set of customers. He suggests “they [offer] a different package of attributes valued only in emerging markets remote from, and unimportant to, the mainstream.”

From this perspective, the emergence of the iPad, Netflix and Skype fits the bill. Each offered a once-unknown value in the marketplace that awakened existing consumers and drew in new ones. In fact, the notion of disruption is permeated in western civilization. Without it we may have never seen the likes of the automobile, the ATM, or the smartphone. After all, there was once nothing wrong with fast horses, banking hours, or flip phones.

While it’s tempting to see the introductions of these products in the market as the defining moment of disruption, these newcomers shared a common denominator that preceded their development. That denominator was the fertile environment upon which they were born, making their disruption not only possible—but inevitable.

The Innovation Diffusion/Disruption Model

Fundamentally, why does disruption occur? To answer this, first let’s look at an existing innovation theory to shed some light on the subject.

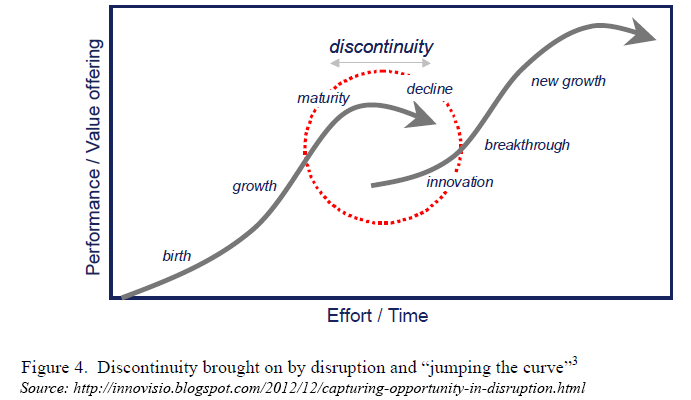

Everett Rogers’ Theory of Diffusion of Innovations illustrates that innovations go through a distinct lifecycle comprised of four stages: early adoption, rapid growth, maturity, and decline.2 At some point during the maturity stage—which he refers to as “discontinuity,” a new innovation initiates an entirely new lifecycle within that given market. While the new innovation initially gains only a small degree of traction in the market (i.e. as with early adopters), it eventually experiences its breakthrough—with rapid growth that quickly displaces the previous innovation, thus becoming the new status quo.

Everett Rogers’ Theory of Diffusion of Innovations illustrates that innovations go through a distinct lifecycle comprised of four stages: early adoption, rapid growth, maturity, and decline.2 At some point during the maturity stage—which he refers to as “discontinuity,” a new innovation initiates an entirely new lifecycle within that given market. While the new innovation initially gains only a small degree of traction in the market (i.e. as with early adopters), it eventually experiences its breakthrough—with rapid growth that quickly displaces the previous innovation, thus becoming the new status quo.

Rogers’ theory centers on how products cascade into the marketplace as a whole. It’s largely about market readiness and adoption patterns, rather than from the environmental Petri dish from which they emerge.

The Dynamics of Disruption

While this iconic model is accepted as conventional wisdom, it omits a crucial element. It does not explain why periods of discontinuity arise, or why certain times are more fertile for disruption than others. In other words, it does not explore what precipitates the unseating of “the incumbent” and the rise of “the challenger”.

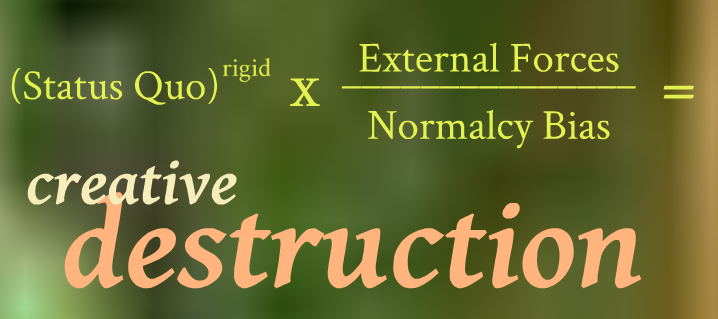

To demonstrate this, along with our O2 Integrated colleague, Jason Raguso, we have devised a formula that illuminates the relationship between internal and external tension. The likelihood of creative disruption [of the incumbent] is a function of three factors: 1) the rigidity of the status quo, 2) the intensity of external forces, and 3) the degree of normalcy bias at play.

In practical terms, let’s explain the variables:

In practical terms, let’s explain the variables:

(Status quo)^rigid – When there is general consensus on a “standard operating procedure”, we have a rigid status quo. In this scenario, the practice becomes so engrained that there appears to be no viable alternatives. A great example of this is when Blockbuster dominated the in-home entertainment market. In North America, it was commonplace for nearly everyone to make movie rentals a part of their routine. That’s just what you did—especially on Friday nights.

External Forces – The chance of disruption increases with the strength of external forces bearing down on a given market. These forces are often different in nature. But what they share in common is the potential to create new kinds of value. In our Blockbuster example, the rapid evolution of the Internet’s infrastructure (and speed) coupled with the rise of digital media, and the proliferation of smart devices created an undeniable boon for the “challenger” NetFlix.

Normalcy Bias – Disruption becomes more likely when key market players are in denial about the future being radically different from the past. To wit: in 2008 (just 24 months before its bankruptcy filing), Blockbuster’s CEO was quoted as saying, “Netflix isn’t even on our radar as a competitor.” Blockbuster didn’t see the linkage—and simply kept opening stores, while offering customers a wider selection of candy, popcorn and novelties to complement their rental. A great example of the phrase, “Denial ain’t just a river in Egypt.”

Bringing this Theory Closer to Home

Now that we understand the basic dynamics of disruption, let’s put our own industry lens on these variables. I think you’ll see why some of our methods, too, have become vulnerable for disruption. One could argue smartphones have the potential to disrupt online surveys as we know them today. Similarly, because of the changing face of connectivity, focus group facilities are either radically reinventing themselves, or closing down altogether.

Looking at a widely acknowledged disruptive innovation, let’s examine a technique that has experienced an upswing in our industry:

(Status quo)^rigid: Market research online communities have gone from being a fringe technique a decade ago to a mainstream method today. As evidence of this, the most recent GRIT Report cited them as being deployed by 44% of responding client organizations and 50% of responding suppliers. When a technique reaches this level of adoption, it has clearly achieved status quo – with a generally accepted cadence of weekly activities and topics strongly driven by the client. Communities have been engineered for efficiency, connecting corporations with hundreds, even thousands, of consumers in real-time. This lends itself to a concrete, and generally accepted, notion of what MROCs are, and what they intend to deliver.

External Forces: Since the advent of MROC’s, a lot has changed. It’s no longer enough for researchers to churn and burn ad hoc insights. Rather, they’re being challenged to connect insights to the broader framework of the business. Additionally, insights teams are increasingly scrutinized to deliver a higher return on resources. In this light, communities must become more than a clearinghouse for quick turnaround queries. They will need to be fundamentally rebuilt, adding new dimensions that catalyze strategic learning.

Normalcy Bias: It’s fairly clear that normalcy bias is strongly at play in the mainstream of our industry. There’s a common feeling that, while change is encroaching on our profession, it will be slow, gradual and orderly. After all, our 70 years spent fixating on methodical purity and sample representativeness got us to where we are today. Therefore it’s not surprising that ten years in, MROCs are still not as fully adopted as online surveys. [As qualitative evidence of this, see below comments from a 7/9/13 post “5 Things That Will Become Obsolete in MR Sooner Than You Think.“]1

Normalcy Bias: It’s fairly clear that normalcy bias is strongly at play in the mainstream of our industry. There’s a common feeling that, while change is encroaching on our profession, it will be slow, gradual and orderly. After all, our 70 years spent fixating on methodical purity and sample representativeness got us to where we are today. Therefore it’s not surprising that ten years in, MROCs are still not as fully adopted as online surveys. [As qualitative evidence of this, see below comments from a 7/9/13 post “5 Things That Will Become Obsolete in MR Sooner Than You Think.“]1

So What Does this all Mean?

As an industry, if our primary reason for being is to guide organizations toward smarter consumer-centric decisions, then our path to delivering that value is certain to evolve over time. We’re bound to see ebbs and flows—periods where fresh ideas will create a new trajectory to “jump the curve.”

In our MROC example, it’s clear that the conditions are ripe for “re-disruption.” In particular, while the social media revolution inspired the first incarnation of private online communities, we think internal stakeholder demands will inspire the next generation of them.

To help articulate this, Joyce Salisbury, Technical Director, Global Market Research for General Motors suggests, “[Organizational] Intelligence is built up over time. It is a constant feeding of information. Decision makers need this information to fuel their intuition, not just fill their brains with facts.”

After all, it is the job of insights agencies to facilitate that—no matter how many many periods of disruptive discontinuity it takes to get there.

—

1“Don’t be so quick to throw out the old tools (you may need them 50 years from now)…else you may not be prepared when the latest ’trend’ proves to be just a trend– and not a proven, reliable method of collecting and analyzing, neutral observations.

“What all of these new-agers seem unable to understand…is that these challenges are nothing new to the research industry, are hardly complex, raise no significant barriers to entry…”

“Online wins on the very basics, cost and timeliness… but one thing I am sure of is mobile will never deliver in that category. Read the MRSUK’s pitiful analysis on the potential for mobile research. Talk about misplaced optimism

2 Image Source:http://innovisio.blogspot.com/2012/12/capturing-opportunity-in-disruption.html